The latest survey results of the semiannual ULI Real Estate Consensus Forecast, prepared by the ULI Center for Capital Markets and Real Estate, pick up on slowing global growth and volatility and are generally less bullish than six months ago. However, those surveyed predicts three more years of mostly favorable real estate conditions in the United States and no imminent downturn. The survey was completed by 48 real estate economists in late August and September 2015.

Some of the highlights from the survey, which covers the 2015–2017 forecast period, include the following:

- Net job growth should be 2.7 million per year, compared with a long-term average of 1.2 million. The job growth forecast is down from 2.9 million in the last update, but is still a very strong prediction, and will bolster real estate demand. Growth may become too strong; some economists are curtailing job growth forecasts in 2017 and 2018 due to a shortage of unemployed workers, although that is not reflected in this forecast.

- The yield on the 10-year U.S. Treasury note will average 2.8 percent through 2017 versus a long-term average of 4.1 percent. The average forecast is 20 basis points lower than in March, consistent with lower global growth and inflation.

- Overall, real estate capital markets are wide open, and commercial real estate transaction volumes will average $503 billion over the next three years, just below the all-time peak of 2007. Debt and equity capital are plentiful and competition is intense for most marketed properties.

- Commercial real estate prices as measured by the Moody’s/RCA Index are projected to rise by 6.8 percent per year, compared with a long-term average increase of 5.4 percent. This is a marked drop from the prior forecast, and from the cyclical peak of 16.5 percent in 2013. The forecast 2017 increase is only 4.5 percent.

- Among the five major property types, the hotel sector is poised for the greatest growth, with average revenue per available room (RevPAR) gains of 6 percent from 2015 to 2017. Office and warehouse rent growth also will be strong at 4 percent per year. All three property types are up slightly from the prior forecast.

- NCREIF (core unleveraged properties) total returns should average 9.2 percent, below the long-term trend, but a 640-basis-point spread over expected U.S. Treasury yields. This spread, if realized, would be significantly higher than the 20-year average spread of 5.9 percent.

- Commercial mortgage–backed security (CMBS) issuance should rise to $140 billion in 2017, compared with a 20-year average of $71 billion, but will remain well below the pre–global financial crisis peak of $229 billion. CMBS spreads have risen over the past month, partly due to lower base rates but also reflective of concerns about growth.

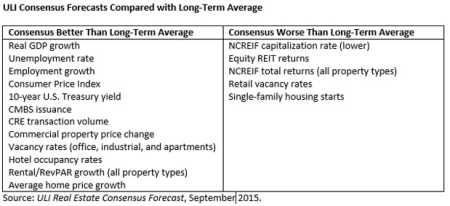

Although the overall survey generally showed steady improvement, a few forecast variables raised some concern. The 10-year U.S. Treasury rate is expected to increase to 3.3 percent in 2017, a 120-basis-point increase over the 2014 level. This forecast is in line with most economists but significantly above the mid–2 percent rate implied by the forward yield curve. Consistent with higher interest rates and borrowing costs, respondents expect the NCREIF capitalization rate to increase to 5.7 percent by 2017, an increase of 50 basis points over the forecast cyclical low in 2015. If growth slows and interest rates stay low, these cap rates may stay low as well. Finally, the headline inflation rate will move to 2.2 percent by 2017 (from 0.8 percent in 2014), just below the 20-year average, but below the 3 percent rate used in most underwriting.

There were a few other areas where the experts registered concern. As was the case in the prior survey, real estate investment trust (REIT) returns, retail occupancy rates, and housing starts are all projected to fall below their long-term averages. Equity REIT returns—in negative territory so far this year—are forecast to average 4.3 percent from 2015 to 2017, well below the 20-year average of 13.5 percent. With private market values generally higher than public market values, we are starting to see more REIT privatizations, which could boost REIT returns. Retail vacancy rates will remain above average, as store closings and more-frugal consumers weigh on space demand, even as vacancy rates of all other property types fall below long-term averages. Finally, the single-family housing outlook improved over the past six months, although starts will reach 900,000 in 2017, below the long-term average of 1.0 million per year.

In summary, the latest ULI Consensus Forecast has picked up on recent growth concerns and stock market corrections around the world. The U.S. economy and real estate markets are in much better shape than most other countries’, but global economies and capital markets are increasingly inter-related. Still, the vast majority of indicators in the forecast indicate favorable economic and capital markets in the United States, as well as moderately strong real estate fundamentals and investment returns. Compared with many parts of the world, the United States is a good place to be in the real estate business.